Simple Savings Newsletter - January 2019

- Save $10,000 in 12 Months

- Do You Have 'Poor Habits'?

- How Much Will You Save by Changing Just ONE Habit?

- Your 12 Month Habit Changer is HERE

- The Save-O-Meter is BACK, Baby!

- Competition Winners: Inspiring Wealthy Habits

- New Competition: Get Growing

- Best Gluten Free Bread Ever!

Happy New Year!

2019 is going to be a great year, I'm really looking forward to it!

Let's get straight into it!

Fiona

1. Save $10,000 in 12 Months

Yes, you read right! We challenge you to save $10,000 in the next 12 months by swapping your wasteful 'poor habits' for clever, frugal 'wealthy habits'.

Before you dismiss that as being impossible, first have a look at the numbers and our list of poor habits. These are some of the possible savings you can make by switching from poor habits to wealthy ones.

Habit Savings

| Poor Habit | Cost | Wealthy Habit | Cost | Week | Year | 10 Year |

| Buying meat | $50 | Becoming Flexitarian | $10 | $40 | $2,080 | $20,800 |

| Over fuel budget | $30 | Car pooling | $15 | $15 | $780 | $7,800 |

| Kmart addiction | $23 | Visiting Garage sales | $5 | $18 | $936 | $9,360 |

| Buying lunch | $80 | Making food at home | $20 | $60 | $3,120 | $31,200 |

| Drinking alcohol | $80 | Not drinking | $0 | $80 | $4,160 | $41,600 |

| Smoking (3 packs/wk) | $96 | Not smoking | $0 | $96 | $4,992 | $49,920 |

| Ready made groceries | $180 | Food from scratch | $90 | $90 | $4,680 | $46,800 |

| Takeaway once a week | $30 | 'Leftover night' | $0 | $30 | $1,560 | $15,600 |

| Pokies | $40 | Candy Crush | $0 | $40 | $2,080 | $20,800 |

| All clothing brand new | $40 | Clothes from Op Shop | $10 | $30 | $1,560 | $15,600 |

| Buying coffees at work | $40 | Box of coffee bags | $7 | $33 | $1,716 | $17,160 |

| 3 bottles of wine a week | $30 | 1 bottle on Friday | $10 | $20 | $1,040 | $10,400 |

| Buying fresh milk | $15 | Using powdered milk | $4 | $11 | $572 | $5,720 |

| Drinking Coke | $14 | Drinking water | $0 | $14 | $728 | $7,280 |

| Total savings | $577 | $30,004 | $300,040 | |||

Good grief, how quickly do those numbers add up? And we've only listed 14 of countless poor habits. But, no worries. We have made a second list! This one is FULL of them.

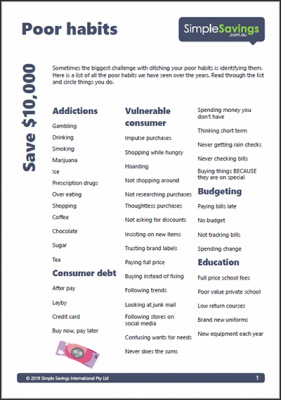

2. Do You Have 'Poor Habits'?

There's an easy way to find out - simply click here to download our list! We've made it a free printable resource, to help keep you on track all year round.

3. How Much Will You Save by Changing Just ONE Habit?

What sort of difference would changing one habit make to your life? The answer may blow your mind. To give you an idea, we have made a free printable for you to work out how much money you can save:

Full members get the full package!

Our entire Wealthy Habits program is available to paid members. If you aren't yet a full member it costs just $21 a year to become one and you can save much, much more. You can upgrade your membership here.

4. Your 12 Month Habit Changer is HERE

Here at Simple Savings, we really do want our members to be happy. That's why we have a 365 day refund policy. So if you aren't sure whether or not you are going to like the program, you can become a paid member and download the full version. If you don't like it, simply ask for your money back. How easy is that? You have nothing to lose and everything to gain.

5. The Save-O-Meter is BACK, Baby!

Do you remember our beloved Save-O-Meter? Members used to use this feature to track their saving successes. As well as keeping track of your individual saving, it also added up everyone's collective saving. Together, we saved an astounding 46 MILLION DOLLARS in the few years it was running.

The great news is, it's back! Better still it's absolutely free to enter in your savings as they happen, all year round. No personal information is required, only the savings you make for your own satisfaction and to share the joy with others. So pop over, check it out and have fun saving with us!

6. Competition Winners: Inspiring Wealthy Habits

Last month's entries for our 'Inspiring Others to Adopt Wealthy Habits' competition were fantastic. So good in fact, we had to increase the number of prize winners! Here are our five favourites:

A whole day's work for just one meal

'My husband is a spender, but I am a saver. To curb his wasteful spending I suggested he think about how many hours he would have to work to earn the money he wanted to spend. For example, if he wanted to take our family of five out to dinner, that would cost about $100 to $120 at our local club, which is equal to approximately one day of work, just for one meal. That was a few years ago now and his spending habits have changed dramatically. He no longer wants to frivolously spend money he worked so hard to earn and has become a real bargain hunter!'

Contributed by: Jacquelene P.

Let your spending reflect your values

'The best piece of advice I was given is to ask "Is this in line with my values? Is buying this what is important to me?" I find that asking myself this with all my purchases and expenses means that I spend my money in a way that more accurately reflects who I am and what matters most to me in life. Therefore I am less likely to get hooked into brand names, or cosmetics, or fashion, or trends, or mindless spending because these things do not matter to me. Removing the spending that doesn't fit with our values gives us the freedom to put money into the things that mean the most. In turn this increases our joy and sense of fulfillment in life.

It's all about choice - and the choice is yours

The advice I would give to someone who is wanting to save but is extravagant is to say "You get to choose. It's your money, and you get to decide what's important to you. If these habits such as buying new clothes and eating out each week, fine, spend on them. But if they aren't what you really want; if there are things that are more important to you, then it's your choice. When you spend money in one area of your life, you are choosing not to allocate it to another. If you are choosing to live beyond your means, then you are choosing debt. It's up to you."

I am all about choice, and freedom. I know I can choose to spend my money on things that won't last and won't ultimately bring me happiness. They may even bring misery (debt) or regret, or I can choose to spend on things that enhance my life, and the lives of others and bring peace of mind and joy. It's all about choice'.

Contributed by: Nicki C

How much is your time REALLY worth?

'There are two things people have said to me, which have helped me to change my mindset around spending. The first was to consider my hourly wage when making a purchase. To ask myself how much time I would be paying for this item, and if I would really be prepared to work that amount of time simply for whatever I was about to purchase - or look for a more cost effective alternative.

The second tip applies to clothing. I try to keep a wardrobe of clothes that I love, and to only buy new clothes to replace those that have been worn out. I was told when purchasing clothes to consider the cost in the amount of time worn. If I imagined that I was hiring the item and had to pay per use, the total cost of hiring the item each time would be the cost of purchasing it. As a result, I allow myself to look for higher quality (and perhaps more expensive) clothing which are staples and are worn daily/very regularly, and to be much more careful when looking at "special occasion" clothing that may not be worn very often (as well as to make sure that I avoid any "fads" that will only be worn for a short time!).

Contributed by: Gillian Richardson

From daily coffee to early retirement

'That takeaway coffee you buy every day adds up. So does the bought lunch, that cute top you saw that was on special while you were in your lunch hour going for a walk, that extra drink after work - there are lots of things we do daily that eat up our money and make it disappear slowly through the week. If we only think about every dollar we save as money we don't have to work for!

When you write down every cent you spend you can soon see where your wages go. Just imagine all that money redirected into your home loan instead of being frittered away - it could amount to thousands and enable you to pay your debt off quicker. Every dollar saved is like $1.30 after tax in your pocket - and that could even mean earlier retirement, yay!'

Contributed by: Emma K

What IS your goal? Make sure you know!

My advice to others to help with their savings goals is to actually HAVE a goal. It can be as big or as small as you want, but if you have a goal and a direction it will give you purpose and is easier to work out a plan. I find it also helps to make that goal visual. Write it down. Put it up on the wall. Fill in a savings tracker, whatever. Anything you can do to see your progress as you go!

Contributed by: Salli M.

7. New Competition: Get Growing

February is get Growing Month and we are challenging readers to invest in themselves. Some examples of the kind of self-improvement goals we have in mind are:

- Easy: Borrow/buy and read a self-help book and do the work contained in it. (that last part is the tricky bit!)

- Moderate: Enrol in a short course online or at a local vocational college and pick up a skill you've always wanted

- Difficult: Enrol in a diploma or degree qualification in a field you'd like to get into

This month's competition is to inspire others to Get Growing. Tell us about something you've done to improve yourself, and inspire others to follow in your footsteps. What did you do? What did it take, and what impact has it had on your life?

We have four prizes of $50 to award for the winning entries. To enter, send us your entries by January 26th. Email your entries to: competitions@simplesavings.com.au

8. Best Gluten Free Bread Ever!

A couple of months ago, when I mentioned I had found a way to make gluten free bread for $2.40 per kilo, many members wrote in asking for the recipe. Before we get started, I'm going to tell you some of the pros and cons about this recipe.

The good things are:

- Taste. It tastes divine. This is my kids' favourite gluten free bread, better than store bought

- Size. It makes a big enough loaf to make a Breville toastie

- Satisfying. It feels like a real slice of bread

- Texture. Soft enough to wrap around a sausage

The not-quite-so-good things are:

- Equipment. You will need to buy new bread tins

- Time. Making this delicious bread takes a good part out of your day. Twenty minutes to make and mix dough, two hours for the dough to rise, two hours in the oven, two hours to cool before slicing.

The recipe we use originally came from Quirky Cooking and Artisan Bread in Five

While I really liked the taste of their recipe, it was inefficient. I didn't want to spend any more time cooking than necessary. And, I wanted big slices of bread. Big enough to make a jaffle.

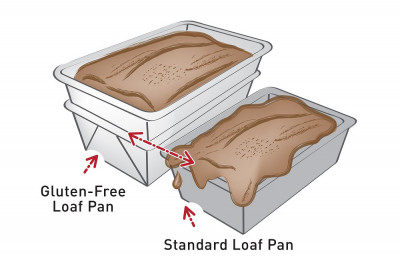

The first problem I had was finding a deep loaf tin. Gluten free bread does not rise the same way regular bread does.

If you want big slices of GF bread, I recommend you invest in two GF bread tins. Mine cost around $25 each.

If you are using a Thermomix, make two batches of dough following Quirky Cooking's method.

If you are using regular cooking methods, make two batches of dough using Bread in Five's recipe.

Once your bread has risen, turn your oven on to 200C and place the dough into your lined loaf tins.

Let the dough rise again till the oven is heated, then cook the bread for two hours.

Remove the bread from the oven and trim the edges to remove it from the GF loaf tin.

Let the bread cool completely before cutting it into very thin slices. I usually store the slices in four containers. The first we eat and the other three go in the freezer.

Ta-daa! You have two beautiful GF loaves.

That's all for now!

I hope you're looking forward to 2019 as much as I am. Stay in touch and let us know what inspirational things you have planned for the year.

All the best,

Fiona