Simple Savings Newsletter - January 2018

This issue includes:

- February is No Spend Month!

- Tips for No Spend Month

- Supporting Each Other in the Forum

- Competitions, Competitions, Competitions!

- We Are Seeking a Writer

Hi,

How are you going? I hope you had a great January and you are ready to take on "No Spend" February.

To help inspire you we have $200 in prizes this month with challenges for every level.

I hope you enjoy them and have a great month.

Many grins,

Fiona Lippey

PS. We have dropped the price of new vault memberships this month from $27 to the renewal price of $21.

Get your membership here.

1. February is No Spend Month!

Have you ever wondered how much money you waste in a week? Have you ever thought; "How little could I live off if I had to?" If so, Now is the time to find out, because February is No Spend Month!

What is No Spend Month?

This is where we challenge you to slash your budget and save as much money as you can by avoiding all non-essential spending.

The rules are as follows:

Your mission is to avoid spending money on ANYTHING in February other than the absolute essentials for your work, education or survival. Obviously there will be some things you cannot avoid, such as basic food and prior bills, but apart from that your mission is to make sure you don't buy anything that is not essential.

For example, this month you should NOT be buying:-

- Takeaway food of any sort

- Lollies or chips

- Dips

- Soft drinks

- Magazines

- Books

- Frozen dinners

- Movies or videos

- Fancy brands

- Bought cakes

- Pre-made food

- Ice cream (wait… What?!)

- Clothing

- Beauty products

- Alcohol

Things you CAN spend money on:-

- Rent or mortgage

- Basic food

- Utilities

- Insurance

- Petrol

- Car

- Health care

- School essentials (meaning uniform, camps or stationery requirements, NOT money for the canteen!)

- Other prior bills (we don't want you incurring late fees!)

Ooh, that sounds a bit harsh! What's in it for me?

Yes, we know it's harsh, but look at that list again... How many of those things do you currently buy each month? How much you would save by NOT buying them for a month? Go on, have a guess... Imagine how much headway you could make! Imagine all the things you could do to get ahead financially if you managed to keep all that money in your bank instead of automatically handing it over to shopkeepers for things you don't need. You could use it to pay off a credit card. You could pay some extra off the mortgage and save a heap of interest. You could use it to create an emergency fund to bring a little extra peace of mind. You could use it for a reward or holiday for your family. Put like that, isn't it worth the effort for a few short weeks?

Just in case you think going without for one whole month is too difficult. We have three challenges for you to choose from:-

- The first is to go without 20 items you were planning on buying.

- The second is to avoid 50 non-essential purchases.

- The third is to go hard core and avoid all non-essential purchases for the entire month.

Pick the challenge that best suits you and grab a notebook to record your success. Every time you avoid spending money, write what it was and how much you saved. This way you can track your success and be proud of how well you're doing.

To help you on your journey we have some quick tips and some great prizes. Read on...

2. Tips for No Spend Month

Find a No Spend Buddy

During a No Spend Month, team up with a like minded buddy or family member and keep an eye on each other. There are so many things you can do in partnership, or on your own, including:

- Raid each others pantry rather than make a trip to the shops

- When heading out to run errands, make one trip for both of you

- Pay bills online

- Raid each others cupboards or gardens before buying gifts

- Cancel the lawn-mowing for the month

- When cooking, cook surplus and deliver to your buddy

- Make greeting cards from household materials including card and glitter. Use downloadable images too

As you've seen, no spend is no problem!

Alcohol-free February

Being in your mid to late twenties and saving for a house is very tough these days. Most of my peers have given up on the idea of ever getting into the property market, as it's so difficult. This can make it hard for me to keep on track with my saving, especially when my friends often want to go out for dinner and drinks.

Going out for drinks all the time also takes its toll on your health, so to give myself a health kick and a financial boost I've decided to combine No Spend February with Alcohol-Free February. Not only do I save money by not buying drinks when I'm out; I also save on taxi fares because I'm happy to be the designated driver.

It's only been a week so far, but I already feel great and am amazed how much I've saved!

Contributed by: Rachy Bee

Beat the savings slump with a new challenge

Our family got its savings mojo back this month and reduced our grocery bill by 50%! Those of you who have been doing Simple Savings for a while and have paid off your mortgages know how it is easy to slip with saving. Whilst a mortgage is a drive for many people to save, since paying ours off I realised our efforts had waned. The motivation to save had gone. So our family took February's No Spend Month to the extreme and bought only half our usual amount of groceries. We spent $400 instead of $800 or more and instead of buying, we made biscuits and bread, ate everything in the vegie garden that could be eaten (lots of silverbeet!), used the stocks in the pantry and freezer, ate leftovers religiously and made presents instead of buying. The result was that my husband's hard earned wages were hardly touched for the month compared to usual! This has motivated me to save more and more each month to save for a caravan and nice family holidays, including a trip around Europe! Thanks Simple Savings!

Contributed by: Belinda Lansley

An idea with quirks that works

I know this hint is a little quirky, but it works for me so I thought I'd share it with you.

I used to love to buy things, just for the sake of it. It didn't matter what it was, who it was for or how much it cost. I just couldn't help going out, buying something and bringing it home. As you can imagine, this shopping habit got me into a lot of financial trouble. Even after cancelling my credit cards and devising a budget, I still had these shopping cravings. So I came up with this unusual plan:

I now borrow items from the library to curb my appetite for buying things!

I warned you it was a little crazy.

Instead of going to the shops and using my credit card or splashing out cash, I go to the library, (sometimes with a list!) and borrow things. Magazines, DVDs, CDs and books all come home in my recycled shopping bag, with my 'receipt' (return due date receipt) and I even use my 'credit card' (library card) to pay for them. It really does work. Now I just have to devise a plan to get them back on time and not pay overdue borrowing fees!

Contributed by: Roxy M

No Spend Month every three months

I have come up with a system that gives me a No Spend Month every three months! With just me at home I had become lazy with my grocery shopping; in fact I was grabbing takeaway or eating just a sandwich and was making myself ill from not eating properly. I discovered a weekly menu, complete with shopping list in a magazine. So I crossed off what I didn't like and headed for the supermarket.

It was not until I was on my way home that this aged brain suddenly realised I had bought enough ingredients for four of each meal. Out of stupidity and lack of thought I had actually hit on a winner. The next few nights I cooked the meals, made one serving for me and froze the rest in meal lots. Over the next few weeks I added to my meal list and ended up with a variety of meals from which to choose, plus I saved myself literally hundreds of dollars by stopping panic buying and takeaways. And of course I was at last eating in a healthy way.

Every three months I have enough meals to last me for the entire month, plus I can feed any unexpected visitors. I have made sure that it does not become boring and have now incorporated the same system into work lunches and every now and then breakfasts.

So, all in all the old girl has now become this very budget conscious, gourmet cook and I have to admit it has given me a real sense of achievement. Money is still tight, but I am not being strangled by the lack of it anymore.

Contributed by: Lynn Earley

If you like these tips and want more we have another 18,659 of them in our members area. If you would like a membership, it is a tiny $21 per year. Grab a membership here.

3. Supporting Each Other in the Forum

If you would like a helping hand with your No Spend challenges or if you are No Spend Master ready to guide others, pop into our paid members' forum.

In the forum you can start your own No Spend Challenge thread, similar to the one SalliMumof3 started or join the group thread started by the always magnificent Claire M.

The forum is for paid Vault Members only. If you would like a membership, it is a tiny $21 per year. Grab a membership here.

4. Competitions, Competitions, Competitions!

We want to watch you succeed at your No Spend Challenge, and we would like to share your success to inspire others. To encourage you to show us how well you are doing we are giving away $200 in prizes.

The winners will be the most inspiring story in each category. Please send your No Spend Challenge tales to competitions@simplesavings.com.au by midnight, March 1st. Here are the three categories:

- Category 1: Show us how you avoided 20 non-essential purchases to win $25

- Category 2: Show us how you avoided 50 non-essential purchases to win $50

- Category 3: Show us how you avoided all non-essential purchases to win $125

Please make sure your emails states which category you are entering. The full competition rules are here.

Last Month's Winners: T-shirts and Dinners

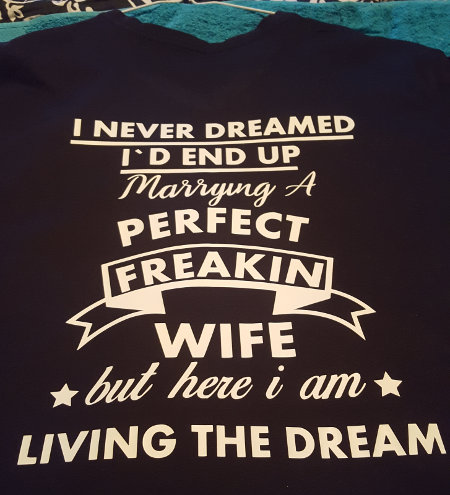

The shirt competition was won by Janine Daniels she made her husband a T-shirt that would be perfect for my husband. Janine has won $50 for her great effort.

Mona won $50 in our Dinner table competition. Here is one of her delicious dinner photos.

5. We Are Seeking a Writer

Simple Savings needs a new writer. If you are a master wordsmith, love helping people and have a spare 4-5 hours a week, send me an email (jobs@simplesavings.com.au) and tell me why you would be perfect for the job.

Till next time...

Goodbye for now... I hope you have a fantastic month. I'm really looking forward to hearing how your "No Spend" Challenges go.

Many grins,

Fiona